- Moneyspire invoices how to#

- Moneyspire invoices pro#

- Moneyspire invoices download#

- Moneyspire invoices free#

I regularly suggest this free money management app to friends and family. That compounds to tens of thousands of dollars in savings over time. That led me to make some changes, and ultimately I saved $300 per year in fees. When I signed up back in 2012, I used Personal Capital's tools to take a closer look at the investment fees on my mutual funds and ETFs. Just connect your financial accounts and Personal Capital will take care of the rest.

Personal Capital breaks down your asset allocation, shows your portfolio performance by account or across accounts, calculates your net worth and gives a high-level overview of your cash flow by category. The free online money tools do an excellent job of helping you understand your investments. The only “string attached” is that the company may try to sell you on its investment services if you have $100,000 or more in investable assets. You can use the investment tools even if you don't pay to use Personal Capital as an investment manager. It's an investment management service that also offers a free personal finance dashboard. Personal Capital, Quicken and Moneydance each give you a digital personal finance dashboard with the most important details about your money at your fingertips. But if you need more help with budgeting than investing, one of the others could be worth the price. If your sole focus is cost, jump right to Personal Capital, which offers a free financial analysis tool. Depending on what you want from a money management app, you may find that one is a better fit than the others for your needs. Wouldn't it be great to have a way to view them all together? However, it's likely you have several separate investment, credit card and bank accounts. If you're serious about your money, you know it's important to keep tabs on your various financial accounts. We may receive compensation when you click on links to those products or services This article/post contains references to products or services from one or more of our advertisers or partners.

Moneyspire invoices how to#

How to Boost Your Savings With a CD Ladder.What’s the Difference Between Saving and Investing?.Best High-Yield Savings Accounts For 2021.

Moneyspire invoices pro#

Create customer invoices with the Pro version. Optionally sync to the cloud (if you would like) via the Moneyspire Cloud feature so you can share your finances between multiple computers and mobile devices.

Moneyspire invoices download#

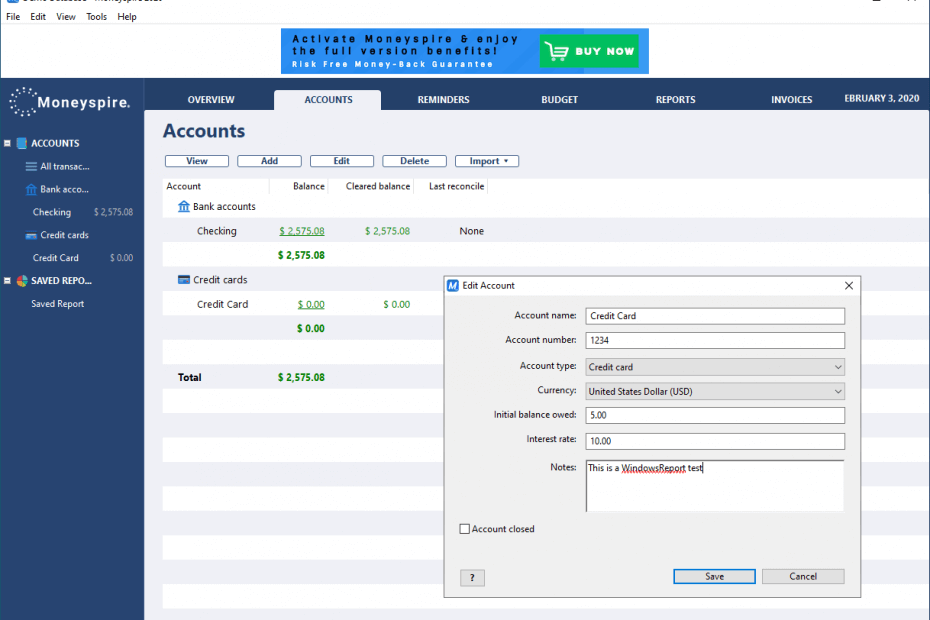

Optionally sync to your financial institutions (if you would like) via the Moneyspire Connect feature and automatically download your transactions. Generate detailed reports to see exactly where your money is going and to make tax time easier. Balance your checkbook and reconcile with bank statements to catch errors and bank fraud. Forecast your account balance to prevent overdrafts and insufficient funds. Set a budget to keep track of your spending so you don't overspend on specified categories like Dining Out. Keep track of your bills so you never forget to make a payment again and avoid late fees. Categorize your spending and income with customizable categories. What does Moneyspire 2020 do? Keep track of your bank accounts, credit cards, loans, cash or investment accounts.

0 kommentar(er)

0 kommentar(er)